Engineering and construction costs rose for the eighth consecutive month in June, according to IHS Markit and the Procurement Executives Group (PEG), as materials and equipment costs continued to push costs upward. Semiconductor supply has proven especially troublesome as manufacturers struggle to ramp up production to meet expanding demand in a post-pandemic economy.

“Following the lifting of lockdown measures in various countries, semiconductor manufacturers did not have the opportunity to match the pace of production with the rapid recovery in demand in the automotive and industrial electronics sectors,” said David Smith, electrical machinery pricing analyst, IHS Markit. “With most of the semiconductor supply concentrated in Japan, South Korea, Taiwan and mainland China, manufacturers have given obvious preference to local demand first, especially as freight costs remain so high globally. Procuring these inputs in the Western Hemisphere remains difficult, given delivery times and transportation costs remain elevated and will remain so for the foreseeable future.”

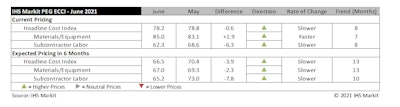

So, even though the IHS Markit PEG Engineering and Construction Cost Index saw a slight decline of 0.6 index points from May's reading, registering 78.2 in June, it remains firmly entrenched in expansion territory, per the report.

Costs Maintain an Upward March

For the past seven months, the materials and equipment sub-index has reflected escalating prices, which caused it to rise another 1.9 index points in June to a 85.0. All categories under the materials and equipment sub-index maintained a sixth consecutive month of increases in June, though index levels fell from last month in several categories. Most survey respondents did not report any shortages for materials and equipment currently, other than restrictions due to shipping.

Of note:

- Copper prices have increased for the past year, reaching an index figure of 87.5 in both May and June, the highest readings since January 2021.

- Costs of ocean freight from Europe and Asia to the U.S. rose for the tenth month in a row, with both categories hitting a new index peak of 95.5.

- The electrical equipment and transformers sub-indices remained high in June at 95.0 and 87.5, respectively, as demand for semiconductors outpaces available supply.

Conversely, subcontractor labor saw a decline of 6.3 index points, bringing the index reading to 62.3 in June vs. May's 68.6. IHS Markit sees this as a reflection of less consensus among survey respondents regarding labor cost increases compared to the prior month. Despite this, overall, labor costs continued to climb for the fifth straight month in each region of the U.S. and Canada, according to survey responses.

Looking longer term, the outlook for the coming six months reflects survey respondents' expectations for future construction cost increases through the remainder of 2021, with the six-month index coming in at 66.5 overall. The materials and equipment component registered at 67.0 in June, while subcontractor labor had a reading of 65.2. IHS Markit notes that labor costs are expected to continue to rise in all regions of the U.S. and Canada, based on survey responses.

Information provided by IHS Markit and edited by Becky Schultz.