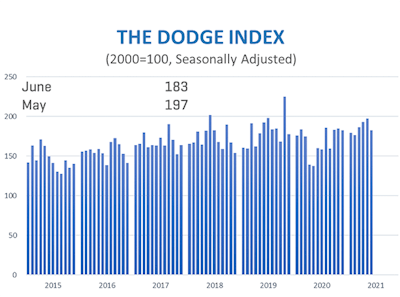

Total construction starts fell for the second straight month, with all three major industry sectors (residential, nonresidential building and nonbuilding) seeing a pullback. Dodge Data & Analytics reports a 7% decline in total starts in June to a seasonally adjusted annual rate of $863.6 billion. Regionally, starts rose in the Northeast but fell in all other regions.

The shortfall is being attributed to the detrimental effects of rising material costs on single-family housing, plus the absence of large nonresidential building and nonbuilding projects breaking ground in June compared to the prior month.

Conversely, a budding recovery appears to be at hand for the nonresidential building sector as projects in the planning stage continue to pile up.

“These mixed signals coming from both residential and nonresidential construction starts suggest that recovery from the pandemic will remain uneven in coming months as rising materials prices and labor shortages weigh on the industry,” Branch comments.

Uncertainty, Building Costs and Labor Shortages Weigh Dodge Momentum Index Down in June

Nonbuilding construction

Nonbuilding construction starts dipped 13% in June to a seasonally adjusted annual rate of $171.8 billion. While highway and bridge starts fell 7% after a 9% upswing in May, the overall decline was the result of a 63% drop in the utility and gas plant category following a large increase (+22%) for the prior month. If the utility/gas plant category were excluded, total nonbuilding starts would actually be up 3% due to gains in environmental public works and miscellaneous nonbuilding.

The largest nonbuilding projects to break ground in June included:

- a $453 million sewer overflow project in Pawtucket, RI

- the $439 million Bay Park Conveyance Project in Cedar Creek, NY

- the $390 million I-5 North Capacity Enhancement project in Los Angeles, CA

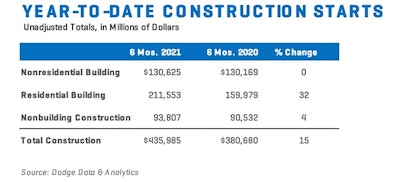

For the first six months of 2021, starts were up 4% overall despite weakness in two of the four key segments:

- Environmental public works surged 35%

- Utility/gas plants gained 13%

- Miscellaneous nonbuilding fell 6%

- Highway and bridge starts declined 9%

For the 12 months ending June 2021, total nonbuilding starts were 6% lower vs. the same period ending June 2020. Environmental public works starts were up a healthy 23%. However, total starts were dragged downward by a 20% decline in utility and gas plant, a 3% slip in highway and bridge and a 22% slide in miscellaneous nonbuilding.

Nonresidential building

Nonresidential building starts dropped 7% in June to a seasonally adjusted annual rate of $288.0 billion. Though large healthcare and manufacturing projects provided a significant boost in May, Dodge Data notes the absence of similar projects in June led to "normalized starts activity." Without this influence, nonresidential starts would have increased 10% in June.

- Commercial starts were up 12% with all categories posting gains

- Institutional starts fell 9%

- Manufacturing starts plummeted 62%

The largest nonresidential building projects to break ground in June included:

- the $1.0 billion Research and Development District office project in San Diego, CA

- the $470 million second phase of the Oyster Point Offices in San Francisco, CA

- the $410 million Amazon distribution center in Rochester, NY

Nonresidential building starts through the first six months of 2021 were slightly ahead of the first six months of 2020. Commercial starts were up 7% and manufacturing starts were 36% higher, while institutional starts were 5% lower.

For the 12 months ending June 2021, nonresidential building starts were 14% lower than the 12 months ending June 2020.

- Commercial starts were down 18%

- Institutional starts fell 10%

- Manufacturing starts plunged 42%

Residential building

Residential building starts fell 5% in June to a seasonally adjusted annual rate of $403.8 billion. Single-family starts lost 8%, while multifamily starts rose slight (+2%).

The largest multifamily structures to break ground in June were:

- the $400 million Courthouse Commons project in San Diego, CA

- the $267 million 1900 Crystal Ave residences in Arlington, VA

- the $250 million Five Park Condominiums and Apartments in Miami Beach, FL

For the first six months of 2021, total residential starts were 32% higher than the same period a year ago. Single-family starts were up 37% and multifamily starts was up 19%.

For the 12 months ending June 2021, total residential starts were 22% higher compared to the same period in the prior year. Single-family starts gained 29%, while multifamily starts were up 5% on a 12-month sum basis.

Information provided by Dodge Data & Analytics and edited by Becky Schultz.