Although commercial and multifamily construction starts across major metro areas have seen ongoing gains throughout the first half of 2021, and civil contractors remain optimistic about work volume going forward, the upward march of materials prices and ongoing pandemic risks continue to weigh heavily on U.S. construction starts. Total starts fell another 3% in July on top of a 7% decline the prior month to a seasonally adjusted annual rate of $854.8 billion. Dodge Data & Analytics reports that despite a few bright spots, all three major industry sectors shifted downward, pulling starts to a five-month low.

One such bright spot has been the decline in recent weeks in lumber and copper prices, both of which have had negative impacts on housing activity. “However, steel, plastic and other construction-related products are continuing their ascent,” said Richard Branch, chief economist for Dodge Data & Analytics. “These increases will continue to impact construction starts over the coming months, somewhat muting the impact of stronger economic activity.

Another risk is the rising number of COVID-19 cases due to the Delta variant. “While we don’t expect significant business restrictions in response, it is a risk that cannot be fully discounted," Branch commented.

Also a bright spot is projects entering planning, which is a leading indicator of future construction activity. “Projects entering the planning stage remain at levels not seen in several years, and forward progress on an infrastructure program and the federal budget provides hope that brighter days are ahead,” Branch stated.

Construction Starts Month Over Month

Residential building starts declined 6% in July to a seasonally adjusted rate of $400.0 billion. Single-family starts fell 6% and multifamily slid 4%.

The largest multifamily structures to break ground during the month included the $223 million second phase of the Sendero Verde project in New York, NY; $203 million Chestnut Commons in Brooklyn, NY; and $194 million 100 Flatbush mixed-use project in Brooklyn, NY.

Nonresidential building starts saw a 1% dip in July to a seasonally adjusted annual rate of $283.8 billion.

- Commercial starts fell 19% on pullbacks in the warehouse, office and retail sectors, while hotel starts rose for the month.

- Institutional starts climbed 11% on gains in healthcare, recreation and transportation, while education fell.

- Manufacturing starts nearly doubled from June’s level.

The largest nonresidential building projects to break ground were the $1.5 billion JP Morgan Office Tower in New York, NY; $1 billion Inglewood basketball arena in Los Angeles, CA; and $825 million REG Geismar Biofuels Plant in Geismar, LA.

Nonbuilding construction starts slipped just 1% overall for the month to a seasonally adjusted annual rate of $171.0 billion.

- Environmental public works fell 25% after a large gain in June.

- Highway and bridge starts rose 11%.

- Utility/gas plant starts were up a sizable 25%.

- Miscellaneous nonbuilding starts remained flat.

Notable nonbuilding projects to break ground in July were the $728 million I-6 project in Indianapolis, IN, the $315 million Kew Lake Water Supply project in Enid, OK, and the $300 million Cavalier Solar Farm in Surry County, VA.

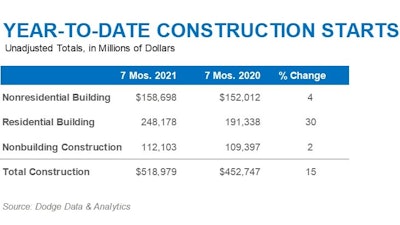

Year to Date and Year Over Year

Despite recent weakness in the single-family sector, residential starts for the first seven months of 2021 were 30% above the same period last year. Single-family starts were up 34% and multifamily were up 19%.

On a year-over-year basis (July 2020 to July 2021), total residential starts were 23% higher, led by single-family starts at +29%, with multifamily lagging but still up 8%.

Nonresidential building starts didn't fare as well on a 12-month basis, coming in 8% lower than the same period in 2020, with commercial starts down 8%, institutional starts down 5% and manufacturing at -26%.

Total nonbuilding starts have saw a modest 2% increase year to date.

- Environmental public works were up 35%.

- Utility/gas plants rose 5%.

- Highway and bridge starts were down 4%.

- Miscellaneous nonbuilding starts fell 19%.

For the 12 months ending July 2021, nonbuilding starts reversed the trend by falling 2%.

- Environmental public works saw a 32% gain.

- Highway and bridge starts experienced a slight 1% uptick.

- Utility and gas plants fell 18%.

- Miscellaneous nonbuilding starts dropped 25%.

Despite only modest gains thus far in 2021, and a slight decline compared to the previous 12-month period, the opportunities for future growth in the nonbuilding could be significant. Earlier this spring, Steve Jones, senior director, Industry Insights Research at Dodge Data & Analytics, predicted even a moderate infrastructure investment package, like the one set to start debate in the House next week, could provide a substantial boost in construction activity in the commercial segment, particularly for highways and bridges.

Primary information for this article provided by Dodge Data & Analytics and edited/enhanced by Becky Schultz.