Total construction starts rose 10% in September to a seasonally adjusted annual rate of $889.7 billion, according to Dodge Construction Network, improving in all five U.S. regions. Nonresidential building starts rose 15%, residential starts moved 9% higher and nonbuilding starts increased by 6%.

“Construction starts have struggled over the last three months as concerns over rising prices, shortages of materials and scarce labor led to declines in activity,” stated Richard Branch, Chief Economist for Dodge Construction Network. “The increase in September, however, partially allays the fear that construction is headed for a free-fall and shows that owners and developers are still ready to move ahead with projects.

“Starts are likely to continue to trend in a positive but sawtooth fashion in the coming months until a more balanced recovery takes hold next year,” he added.

Residential Building

Residential building starts rose 9% in September to a seasonally adjusted annual rate of $430 billion. Single-family starts gained 9% in September, while multifamily starts increased by 24%.

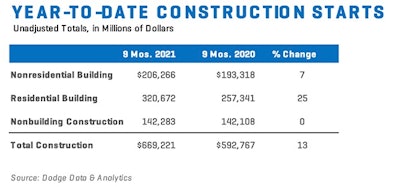

Through nine months, residential starts were 25% higher than in the same period one year ago. Single-family starts gained 26% and multifamily starts grew 20%.

For the 12 months ending in September 2021, total residential starts were 22% higher than the 12 months ending in September 2020. Single-family starts gained 26% and multifamily starts were up 10% on a 12-month sum basis.

The largest multifamily structures to break ground in September were the $300 million Islablue Apartments in Long Beach, NY; the $256 million Station Square Apartments (phase 2A) in Ronkonkoma, NY; and the $215 million 906 W. Randolph mixed-use project in Chicago, IL.

Nonresidential Building

Nonresidential building starts rebounded in September, gaining 15% to a seasonally adjusted annual rate of $281.8 billion.

- Commercial buildings rose 13% as starts improved for the hotel, warehouse and retail sectors.

- Office building starts fell.

- Institutional building starts rose 13% with all sectors but public buildings improving over the month.

- Manufacturing starts jumped 47% following a particularly weak August.

In the first nine months of 2021, nonresidential building starts were 7% higher. Commercial starts increased 8%, manufacturing starts were 38% higher, while institutional starts were up just 2%.

For the 12 months ending in September 2021, nonresidential building starts were 1% lower than in the 12 months ending in September 2020. Commercial starts were down 1%, institutional starts rose 1% and manufacturing starts dropped 12% in the 12 months ending September 2021.

The largest nonresidential building projects to break ground in September were the $670 million modernization program at Pittsburgh International Airport in Pittsburgh, PA; the $658 million Irvine Campus Medical Complex in Irvine, CA; and the $495 million Phillips 66 Sweeny Hub Fractionator in Sweeny, TX.

Nonbuilding Construction

Nonbuilding construction starts rose 6% in September to a seasonally adjusted annual rate of $177.9 billion.

- Miscellaneous nonbuilding starts (pipelines, site work, etc.) and environmental public works (water, sewers, etc.) each gained 29%.

- Highway and bridge starts gained less than 1%.

- Utility/gas plant starts dropped 53%.

Year-to-date, total nonbuilding starts were essentially unchanged through September.

- Environmental public works were 24% higher.

- Highway and bridge starts were 2% lower.

- Miscellaneous nonbuilding fell 14%.

- Utility/gas plant starts fell 10%.

For the 12 months ending in September 2021, total nonbuilding starts were 1% lower than the 12 months ending in September 2020.

- Environmental public works starts were 22% higher.

- Highway and bridge starts were up 3%.

- Utility and gas plant starts were down 20%.

- Miscellaneous nonbuilding starts were 16% lower on a 12-month rolling basis.

The largest nonbuilding projects to break ground in September were the $500 million Whale offshore oil field pipeline near Houston, TX;, the $485 million Chimney Hollow Reservoir Dam in Berthoud, CO; and the $450 million repairs to docks at the United States Coast Guard Station in Fort Macon, NC.