Electric vehicles (EV) and construction equipment aren't what you really need to buy right now, but in the not too distant future, you'll be hard pressed to find a reason not to. Electrification is a hot button issue, not just in the world of manufacturing and construction, but operators and contractors feel a deep sense of connection to the machines they’ve known, used, and relied on for decades.

That’s even more true for the asphalt pavement industry, where pavers are entwined with the identity of their machines similar to the way professional athletes are with their shoe brands. With that in mind, when I heard in early 2023 that LeeBoy, one of the most popular producers of commercial pavers of all different sizes, was bringing a prototype fully electric version of their 8520 model – I was intensely curious to see more.

For one of the leading manufacturers to jump feet first by launching an electric version of the central machine of our industry is pretty exciting, but also risky. So, after seeing it on the show room floor, put on display at PAVE/X when Matt Stanley performed some live demos, and then eventually getting to operate it for myself at the LeeBoy proving grounds in North Carolina; I spoke with the team who developed and manufactured it. Matt Stanley demoing the 8520c at the first PAVE/X.Brandon Noel

Matt Stanley demoing the 8520c at the first PAVE/X.Brandon Noel

“Every new machine or solution from LeeBoy starts it’s life right here,” said Chris Broome, Sr. Product Manager, as he walked me to the physical and metaphoric heart of their plant in Lincolnton, NC. From where we stood, I could see a group of employees, including two of the founding Lees, working on a hulking frame of steel for a massive paver. It was explained to me that they were building a large template to simplify the manufacturing process.

“This is our Seal Team Six, these are our problem solvers," said Broome. "One of the most important things about the electric project was the lessons we learned in its development. Some of those lessons have actually turned around and provided benefits to our diesel line of machines. Obviously, it's nice to be the first to do something, but the process itself has had immeasurable benefits that will carry on to the next innovation, and the next, and so-on.”

On the sweeper side of the industry, there are already a number of electric and hybrid models already on the market, where the efficiency gains by going electric are changing the game. "With our fully electric model [M6 Avalanche EV] we didn't just replace the diesel side, we also replaced all the hydraulics with electric motors," said Jim Adair, Director of Product Management at Schwarze. "We haven't been able to stall-out the brushes, and, whereas, over time your hydraulics will start out at about 80% efficiency and gradually become less efficient over time, the electric system doesn't really experience that."

These first-generation electrics are just a starting point, and they are important steps for our industry as it moves into the future. But, again, they are just the starting point. "Advancements in things like battery materials and density are happening so fast," Adair said. "They're only going to get more cost efficient, safer, and more energy dense."

The State of Electrification

While construction manufacturers have slowly introduced many alternative fuel options into the market place in the form of rollers (Dynapac, BOMAG, Volvo CE, HAMM), street sweepers/brooms (Elgin, Nighthawk, Schwarze, LeeBoy), line stripers (Graco) and excavators (Volvo CE, CAT, etc) as well as, the boom in electric trucks (Ford, Rivian, etc), it is important to note that these investments aren't made based on political whims or public opinion. These companies are built to generate profits, and part of that strategy is to be ahead of the curve on the future of technology and innovation in their markets. Behind closed doors, there's a sea-change happening and what is driving it is an energy revolution.

Graco demoing their traditional and electric machines side-by-side at the first PAVE/X.Adam Rahn

Graco demoing their traditional and electric machines side-by-side at the first PAVE/X.Adam Rahn

This felt like a small, subtle, and, yet, significant verbal move to influence the way we think about EV construction machinery. The machines are still doing the same job, they just run on a different fuel. It forced me to stop thinking about EV and traditional machines as two different things. They are the same thing, doing the same work. This laid the groundwork for what I wanted to communicate about the conversation surrounding electrification.

Investing in the conversion of internal combustion engine (ICE) construction equipment isn't about satisfying a "woke" agenda. Imagine the construction machine industry today is at the same point the cell phone market was between 2005-2007. With the hindsight of nearly twenty years, everyone wants to be the Apple iPhone, and nobody wants to be the LG Chocolate (you not knowing what that is, is the point of the reference, but I was there). Whoever figures "it" out first might dominate their respective market the way Apple has for the last twenty years.

Investment: Watching the Money

How do we know these things are changing? On November 15, 2023, the Biden administration announced via the Department of Energy (DOE) a $3.5 billion investment in the battery and supply chain industry in order to strengthen domestic production, as well as, to protect the country from scenarios where imports might be hindered due to unforeseen circumstances. According to the press release from the DOE:

Batteries are a critical to national competitiveness–for grid storage, for the resilience of homes and businesses, and for electrification of the transportation sector. With the demand for electric vehicles (EVs) and stationary storage alone projected to increase the size of the lithium battery market by five- to ten-fold by the end of the decade, it is essential that the United States invests in the capacity to accelerate the development of a resilient supply chain for high-capacity batteries, including non-lithium batteries.1

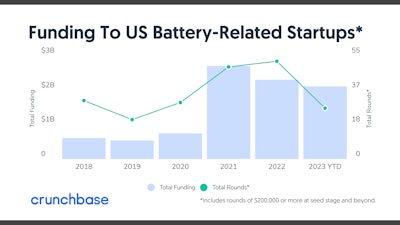

In an article from September 2023, Joanna Glasner, a business and technology columnist covering startup and venture capital trends, wrote about global and domestic battery investments coming from the private sector. She remarked that the projects were likely to be the highest on record.

https://news.crunchbase.com/clean-tech-and-energy/ev-battery-investment-verkor-redwood/

https://news.crunchbase.com/clean-tech-and-energy/ev-battery-investment-verkor-redwood/

"Given that global venture investment is down sharply this year (2023), it’s unusual to see any sector even coming close to 2022 and 2021 numbers. To be on track to exceed them is quite exceptional," Glasner said. "Looking at recently funded rounds, it appears investors pursuing this goal have coalesced around three primary themes: more sustainable battery production, scaled-up EV battery manufacturing, and improved grid storage for renewable energy."3

Adam Levy, a journalist covering tech companies and investments opportunities, wrote just last month that, "Major battery producers are investing heavily to meet rising EV battery demand. Meanwhile, battery technology start-ups are developing new energy storage systems that could revolutionize the industry. It's an exciting time to consider investing in EV battery stocks."4

These are just small windows into where major money moves have been taking place in the energy sector. One thing seems apparent, however, companies are betting on the energy solution of the future, and that future belongs to batteries.

Innovation: Future Proof

Every technology has a predictable lifecycle, but it isn't measured in years, it's measured in phases.5

- Innovation: This is the stage with the highest amount of. Here, you invest time, money and resources into a technology that may or may not work out.

- Growth: The technology begins to gain wider acceptance and adoption. Profits for early adopters and innovators can be high, but competition can also be fierce.

- Maturity: It becomes more standardized and widely adopted, and growth begins to slow down. The market becomes more saturated, and companies focus on reducing costs and increasing efficiency, rather than investing in new innovations.

- Decline: Demand begins to decline. Companies may continue to sell the technology but profits are low, and eventually the technology becomes obsolete.

If you were to place the modern diesel engine on this timeline, where would it fall? Somewhere at the tail of phase three, and not quite yet at phase four. Certainly, no where near phase two. That versus what is happening in the field of electrification and battery science, you can see clearly that it is somewhere in-between the first two phases.

Toyota, who created maybe the most recognizable hybrid of all time with the Prius, has seemingly lagged behind the rest of the auto industry in regards to fully electric vehicles. That is, perhaps, on the verge of a major change. It could also mean the beginning of a widespread revolution.

In November of 2023, Toyota revealed a battery breakthrough. James O'Neil, writing about the technology for TopSpeed.com said, "Its solid-state batteries (SSBs) will allow its EVs to get up to 745 miles per charge. This is a longer range than most ICE vehicles. Perhaps more impressive than the long driving range is the short charging time. Toyota’s solid-state battery can charge in 10 minutes or less."8

The company plans to have it's first SSB vehicle roll off the assembly line three years from now. M6 Avalanche EVProvided by Schwarze Sweepers

M6 Avalanche EVProvided by Schwarze Sweepers

According to a report by GlobalData on EV, over the last three years there have been over 1.7 million patents filed and granted in the automotive industry.9

Cost of Doing Business: Buying Energy

No matter what you choose to power your machines, what everyone is buying is energy. Just like you see on your monthly electric bills, diesel can be expressed in Kilowatt Hours (KwH). The utility company usually breaks it down into a long decimal value, and we can do the same with diesel. A single gallon of fuel is equivalent to ~38/KhW, which is really good, except there's a problem. The engine itself does not convert 100% of that potential energy into mechanical, useable energy. Diesel engines can vary between 30% to 45% efficiency of energy conversion, depending on age, model, and usage. When you hear companies talk about their machines being, "more efficient," that's what they mean. More of the potential energy per gallon is getting turned into power for you paver, excavator, or roller, etc.

Let's break down what this means:

- 1 gallon of diesel = 38KwH (potential energy) • .40 (conversion efficiency) = ~15KwH of mechanical energy per gallon

- The average cost for that gallon in 2023 was ~$4.50 / 15KwH = ~$.30 per/KwH of useable energy

At this point you can see how much you are paying per KwH, how much it literally costs to power your machine. But every machine consumes and requires a different amount of energy. How many KwH are you buying a day? Since we began by looking at the LeeBoy 8520c electric paver, let's begin by analyzing the daily fuel needs for an average commercial paver.

Before I do, however, I know that you probably know off-hand how much fuel you put into your machine a day, and your numbers might look different than mine, and that's ok. These are meant to be averages, not specific figures, but you could replace my numbers with yours and the results will reveal what I'm working towards at the end for you to see. Swap out your number of gallons a day for mine, your average work hours, and so on, to reach your answer.

- Smaller asphalt pavers can require between 5 to 8 gallons of diesel an hour, depending on use7

- An average workday consists of approx. 10 hours based on asking many contractors

- 50-80 gallons a day, conservatively, are needed just to run the paver (not counting your dump trucks, rollers, skid steers, etc.)

- 80 gallons of diesel • 15KwH = 1,200 KwH • $.30 = $360 daily energy cost

It's vital to note that this is not a daily operating cost, because that would also figure in things like regular maintenance. This is purely trying to distill what you are spending on energy to run one asphalt paver.

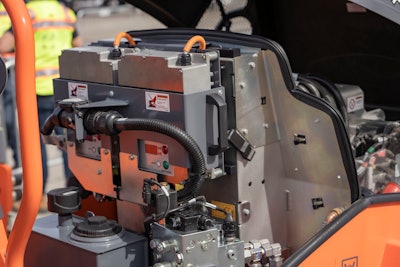

"The 8520c paver battery is 48 KwH. So, basically, I can pave 200-to-300 tons of material with the same energy that is normally contained in 1¼ gallons of diesel fuel," said Chris Broome. "If you only had 1¼ gallons of diesel fuel, how much would you be comfortable paving? You would never order the first truck. That’s the difference in efficiency." HAMM's new electric tandem roller, seen here at the first ever PAVE/X.Adam Rahn

HAMM's new electric tandem roller, seen here at the first ever PAVE/X.Adam Rahn

Additionally, as we've seen since 2020, the diesel cost can be extremely volatile, jumping upwards of $5 -$6 a gallon without warning. I'm sure that many contractors experienced directly how this impacted their job costing, threw off profit margins, or forced them back to customers seeking adjustments based on fuel. Many contractors have added clauses in their contracts with clients to include unexpected fuel hikes, because of how unstable the price can be.

Every jobsite that I've visited has one thing in common. All the machines spend a great deal of time every day idling, waiting for the trucks, waiting for the mat to reach the right temperature before finish rolling, etc. While they are idling, they are still burning fuel. It's a small amount, but it is still working against your cost of energy. You are literally burning money, but getting no mechanical power for it.

Time is Money is Time

When talking about electric motors using these exact same terms, it becomes a little clearer why all these companies are racing to compete in this market. Electric motors have an energy conversion rate of approx. 85% of stored potential energy (battery) into mechanical power. This is nearly double the efficiency of even the most efficient diesel motors on the market. Also, the national averages for commercial utility electricity are $.13 per/KwH. Let's plug these numbers into the same cost formula we used above for diesel, and we will use 38KwH as the base unit, since that would equal 1 gallon's potential energy:

- 1 until of electrical power = 38KwH • .85 (EV conversion efficiency) = ~32KwH of mechanical energy per equivalent unit

- The average commercial cost for that 1 unit of electricity would be (38KwH • $.13) $4.94 / 32KwH = ~$.15 per/KwH of useable energy

That's half of the cost of extracting energy from diesel. Let's carry that through all the way down, just for fun. We will use the same 1,200 KwH from above as a benchmark for how much energy the paver requires in a day to operate.Then, we will work through what this might translate into across a whole season:

- 1,200 KwH (approximate daily required energy) • $.15 = $180 daily energy cost

- $360 (diesel) - $180 (electric) = $180 approx. daily fuel savings

- $180 • 150 (working days a year) = $27,000 approx. annual energy savings

Again, this is just a scenario for a single paver. We could run similar projections for replacing every machine in your fleet that currently has an EV option. Multiply it out for four or five more pieces of equipment, and you could potentially save six-figures a year. Yes, currently, the initial investment costs for these new machines is sometimes two or three times that of a traditional one.

But What About...

I hear a few objections every single time the conversation around EV comes up, and I over heard it at PAVE/X several times when HAMM, LeeBoy, and Graco touted their electric offerings. Some arguments have real merit, and they are important to discuss. The most valid objection is often, though, not the one predominantly brought up: grid infrastructure. Not just charging station availability, but the actual electrical bandwidth and availability.

The most common complaints people levy against the idea of EVs are about charging times, daily battery life, mobile on-site energy solutions, or the fact that, yes, sometimes you might charge an electric machine with a diesel generator. People love to post about that in the comment section of articles about EV. While doing that would mean you're paying the higher per KwH price for that energy, the energy conversion of the electric motor still means a net savings/gain in energy utilized.

However, let's be honest. Are most people pointing out the diesel-generator scenario because they are concerned about emissions or the environment? The same goes for some who point out that asphalt itself is a petroleum based product, as if that somehow negates the potential technological and economic benefits of an EV.

While the inevitable transition to EV will hopefully have some positive environmental impacts, that isn't really the driving force. The driving forces behind this change are essentially the same economic factors that transitioned the world away from whale oil and wood as the dominant sources of fuel-energy in their times. Soon, it will be more expensive for contractors to hang on to the ICE machinery, and those contractors who transition to the more efficient non-ICE machines will have a competitive advantage against the contractors who don't.

The Way of the Dodo

When I started working at a steel factory when I was 22 years old, only one single guy had an iPhone. One guy. It was the coolest thing I had ever seen. So, I was the next guy to get one. It felt like it could do anything. It wasn't just a trinket or a gimmick, it could literally do more. As you well know, over the years nearly everyone got various smart phones, but there were a few hold outs at the factory for a long time.

One guy kept his old flip phone until he accidentally broke it on the job. The next day he came in with an iPhone, and I asked him about it. He said, "I went in and asked for a new flip phone and they didn't have one for me."

Now, you can still find "dumb" phones, and there's a pocket of people who prefer them, but there is no question which type allows you do more. I couldn't do my job without the smart phone. High quality video, fast internet, cloud computing, working on the go, and the ability to have meetings with anyone in the world. It's not that land lines don't exist still, or flip-phones, but the world changed.