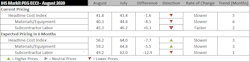

Engineering and Construction costs fell in August, according to IHS Markit (NYSE: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 41.8 in August, another drop from July’s figure of 43.4. Both the materials and equipment and the sub-contractor portions of the index came in below 50, indicating falling prices.

The materials and equipment sub-index recorded the sixth consecutive month of falling prices, with survey respondents reporting falling prices for eight out of the 12 components. Ocean freight (from Asia to The U.S. and Europe to The U.S.) returned to a flat pricing profile. Ready-mix concrete prices, which had increased almost every month of the year, also came in at 50, indicating no change in prices since July. The only commodity showing price increases was copper based wire and cable, building on the copper price rally observed over the last few months. At the other end of the spectrum, prices for fabricated structural steel products have experienced falling prices since March; the price index for fabricated structural steel products currently stands at its lowest level since the PEG survey began.

“In late July, steel sheet prices briefly fell lower in the United States than in mainland China or Europe, without taking the 25 percent tariff into account,” said John Anton, associate director, IHS Markit. “Not surprisingly, U.S. steel imports have collapsed; moreover, low prices will likely force some restarted furnace capacity to be re-idled. U.S. steel prices will be weak through the end of 2020 but should start to recover in 2021 as supply tightens.”

The sub-index for current subcontractor labor costs came in at 45.2 in August, a slight uptick from July’s 40.2. Labor costs were flat in the U.S. Northeast and Midwest; they fell in the U.S. South and West. Labor costs fell in both Eastern and Western Canada.

The six-month headline expectations for future construction costs index was above the neutral mark again in August, at 56.2, though this month’s reading was down from last month’s reading of 64.0, indicating fewer respondents are expecting cost increases. While the materials/equipment sub-index recorded expectations of future price increases, the labor sub-index recorded falling costs.

The six-month materials and equipment expectations index came in at 59.2 this month, down from 64.8 last month, with responders expecting increasing prices for nine out of 12 categories. Prices for several downstream products such as exchangers, transformers and electrical equipment are expected to fall. Expectations for sub-contractor labor registered 49.2 in August, dropping from 62.0 in July. Labor costs are expected to fall in both Eastern and Western Canada. For the United States, labor costs are expected to rise in the South, stay flat in Northeast and West and fall in Midwest.

In the survey comments, respondents continued to note lower demand conditions due to the novel coronavirus (COVID-19) and no shortages for most categories.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.